nh meals tax rate

The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

107 - 340 per gallon or 021 - 067 per 750ml.

. Years ending on or after December 31 2026 NH ID rate is 2. New Hampshire Department of Revenue Administration NHDRA. Years ending on or after December 31 2027.

Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. The BPT rate would be cut from the current 77 to 76 this year. Advertisement Its a change that was proposed by Gov.

Annual Meals Rooms Tax Distribution Report Revenue to Cities and Towns MR Tax Homepage MR Tax Frequently Asked Questions. The 136 billion budget cuts the rate of both the business profits tax and the business enterprise tax. Chris Sununu signed in June.

2022 New Hampshire state sales tax. For additional assistance please call the Department of Revenue Administration at 603. Chris Sununu in this years budget package which passed.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36. The state meals and rooms tax is dropping from 9 to 85. Meals and Rentals TaxRSA Chapter 78-A.

Concord NH The. New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general.

The Meals and Rentals MR Tax was enacted in 1967 at a rate of. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

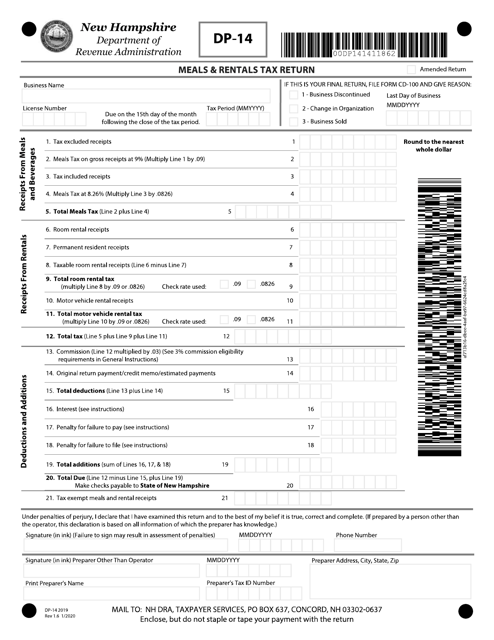

Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the. Choose Avalara sales tax rate tables by state or look up individual rates by address. 1800 per 31-gallon barrel or 005 per 12-oz can.

NH Meals and Rooms tax decreasing by 05 starting Friday. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Concord NH Today Governor Chris Sununu issued the following statement as the reduction in the Meals and Rooms Tax from 9 to 85 takes effect today.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is. New Hampshires sales tax rates for commonly exempted categories are listed below. What is the Meals and Rooms Rentals Tax.

Federal excise tax rates on beer wine and liquor are as follows. New Hampshire Department of. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85.

Years ending on or after December 31 2025 NH ID rate is 3. Choose Avalara sales tax rate tables by state or look up individual rates by address. Some rates might be different in Exeter.

Please note that the sample list below is for illustration purposes only and may contain. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85.

Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. The tax cut which took effect on Friday was part of the state budget that Gov. Meals and Rooms Tax Where The Money Comers From TransparentNH.

Under the new rate a restaurant meal valued at 24 is now. Starting October 1 2021 the New Hampshire Department of Revenue Administration NHDRA is decreasing the states Meals and Rooms Rentals Tax rate from. Exact tax amount may vary for different items.

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Form Dp 14 Download Fillable Pdf Or Fill Online Meals And Rentals Tax Form New Hampshire Templateroller

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

Historical New Hampshire Tax Policy Information Ballotpedia

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Nhdra Reminds Taxpayers Of Meals And Rooms Tax Rate Reduction Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Town Officials Nh Business Review

Understanding New Hampshire Taxes Free State Project

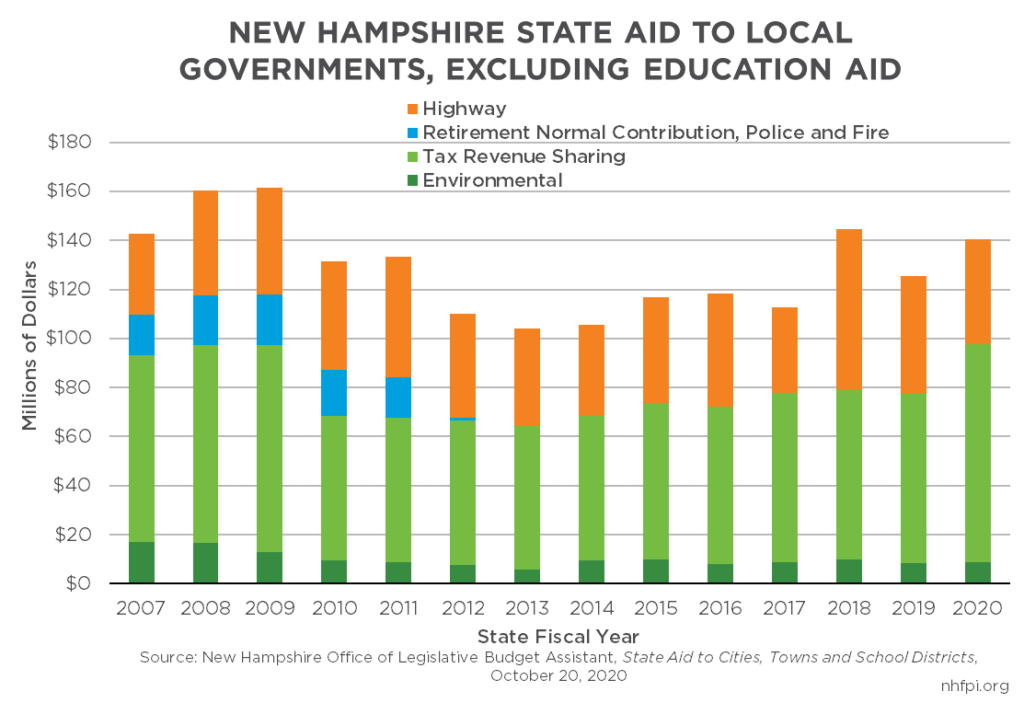

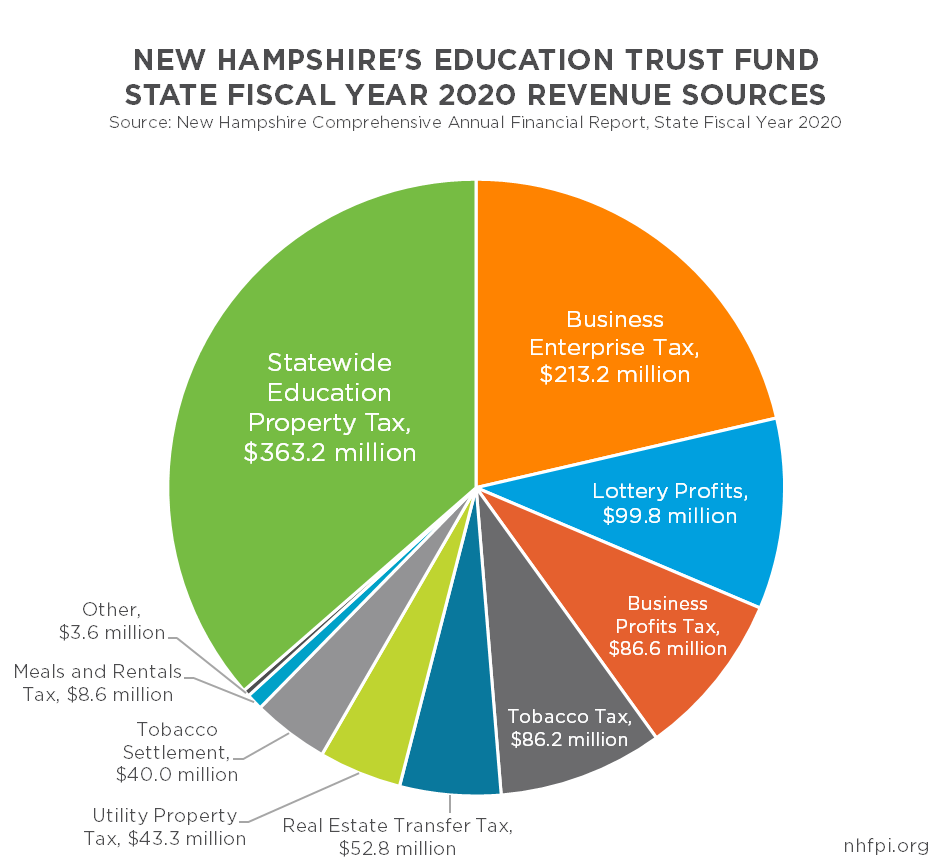

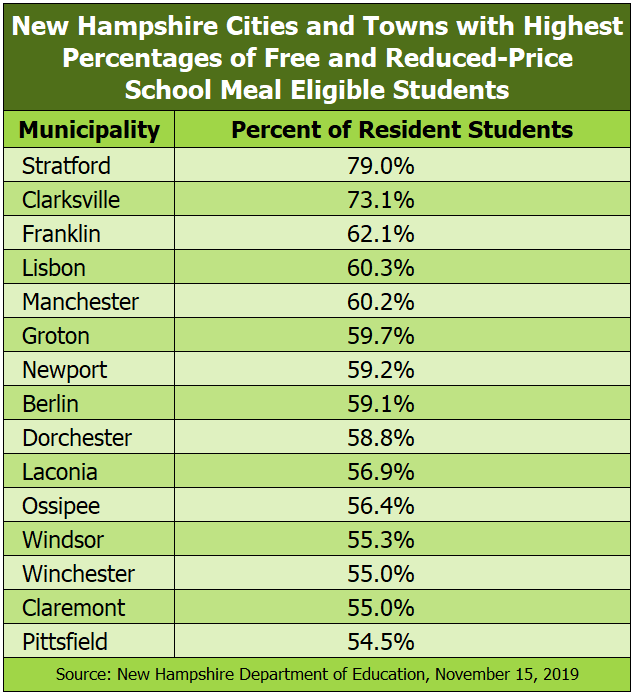

The Governor S Budget Proposal For State Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Sales Tax Rate 2022

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Sales Tax Rate 2022

New Hampshire Meals And Rooms Tax Rate Cut Begins

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Monday Map Sales Tax Exemptions For Groceries Tax Foundation